Secured bonds are backed by assets that can be seized if the bonds are not repaid. Each year until the entire issue is retired.

3 Fictional Characters You Ll Relate To If You Re An Infp Infp Infp Personality Introversion

Serial bonds are bonds which do not mature or come due on a single date.

. Because the bonds mature gradually over a period of years these bonds are used to finance projects that provide a consistent income stream for bond repayment. A sinking fund bond issue. Which of the following statements is true of contrarian stock market investors.

When personal property is attached to or used in connection with real property in such a way as to be treated as part of the real property it is known as a debenture. A serial bond is best described as Athe issuer repaying part of the bonds principal before the final maturity date but paying off the largest portion of the bond at maturity. A serial bond issue.

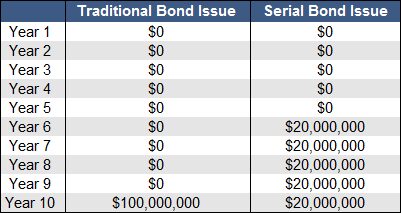

These maturities are known as serial maturities. Secured bonds are backed by real estate mortgages or other assets. For example a 1000000 ten-year serial bond will have 100000 of bonds mature once a year for ten years.

A mass of 50 grams of one chemical is produced. Solution The correct answer is. This results in a gradual decline in the total amount of the issuers debt outstanding.

24 A a bond that matures at one specified time в a bond that is not backed by specific assets C a bond that matures in installments at regular intervals D a bond that gives the bondholder a claim for specific assets 25 A bond is issued at premium_ 25 A when a bonds stated interest rabe is. A callable bond redeemable bond is a type of bond that provides the issuer of the bond with the right but not the obligation to redeem the bond before its maturity date. A bond that matures in installments at regular intervals A bond that gives the bondholder a claim for specific assets A bond that matures at one specified time A bond that is not backed by specific assets.

The city will offer 729 million of tax-exempt bonds tentatively structured as serial bonds maturing in. 24 Which of the following describes a serial bond. A serial bond is a bond issuance where a portion of the total number of bonds are paid off each year.

Call Option A call option is a form of a derivatives contract that gives the call option buyer the right but not. Serial bonds are financial bonds that mature in installments over a period of time. The callable bond is a bond with an embedded call option.

Instead serial bonds have maturity dates which are staggered over several or many years. The required periodic payment of principal to ensure payment of the bond by maturity is referred to as. Because the risk of default will decrease as time goes on serial bonds are perceived to present less credit risk than bonds that all mature at the same time.

Each bond certificate in the issue has an indicated redemption date. 5 Which of the following definitions best describes serial bonds. In effect a 100000 5-year serial bond would mature in a 20000 annuity over a 5-year interval.

Debenture refers to an unsecured bond. Bond issues consisting of a series of blocks of securities maturing in sequence the coupon rate can be different. They invest when the prices of stocks are low.

Which of the following describes a serial bond. A researcher uses several procedures to separate a rock sample into different chemicals. A serial bond is a bond particularly a municipal bond in which a certain proportion installment matures at regular intervals eg.

When the issuer continues to pay back the loan amount to the investor every year in small instalments to reduce the final debt such type of bond is called a Serial Bond. The bond issuer can divide the principal in many ways and you could very well. A serial bond issue is an effective way for an issuer to bring in substantial capital up front while getting out of debt quicker than they might with an issue of bonds that all mature at once.

Bdebt structured so that the principal of the whole issue matures at one time. If you buy a serial bond that matures in five years for example the issuer may divide the principal by five. With serial bonds you receive the principal in equal installments over the life of the bond.

Serial bonds are bonds that are issued at the same time but have staggered maturity dates. If this chemical cannot be separated into other chemicals then it. Annual interest of 7 will be paid on August 31 2021 along with the first principal payment.

Thus it is repaid over a number of periods instead of one specific maturity date. You could say that serial bonds come due over a series of dates. _____ bonds are best described as a sequence of small bond issues of progressively longer maturity.

A capital appreciation bond issue. E The issuer of a bond receives cash when the bond is issued. Indenture refers to a bonds legal contract.

The City of Valley Ridge sold 5-year serial bonds with a principal amount of 750000 for 787500 on September 1 2020. A term bond issue. At the end of each year you receive an installment payment.

A bond issue with staggered maturities would best be described as. Instead of facing a large lump-sum principal re-payment at maturity an issuer can opt to spread the principal repayment over several periods. Serial bonds or installment bonds describes a bond issue that matures in portions over several different dates.

The bonds which allow the Investor to extend the maturity period of the bond are called Extendable Bonds. A serial bond is a bond issue that is structured so that a portion of the outstanding bonds mature at regular intervals until all of the bonds have matured. A serial bond sometimes called a serial note is a debt security that matures and is payable at periodic dates during its term or life.

A serial bond is designed to support the financing needs of a capital. The worksheet on December 31 2020 to record the amortization of the bond premium will result in a n ______. Choose 2 Serial bonds are not a liability Serial bonds have different maturity dates Serial bonds are issued on the same dates.

Acc 630 Acc630 Week 3 Assignment Problems And Exercises Ashford Assignment Problem Assignments Water Utilities

Chapter 14 Mc Chapter Fourteen Multiple Choice Questions 14 1 An Indenture Is Best Described As A B C D A Bond A Contract A Prospectus A Bond Course Hero

0 Comments